Hello Traders and Investors, welcome to all of you on the SkillFinalyst blog. Nowadays there are so many methods and strategies in share market to trade and earn money, Strangle Option is one of those strategies to implement. In this article, we will learn What is a Strangle Option in detail.

Before going on the topic, I tell you, my experience. when I started trading in equity in 2009, it took me 8 years to enter in to Option trading because of no deep understanding and fear, If I would start Option trading in starting 1 or 2 years, I could curtail my struggle in earning money from stock market.

No one was there to guide me what method or strategy should I trade and what to not I learned everything with implementing 100s of methods to reach some profitable methods.

But don’t worry I will share only methods and strategies which exactly work in making profits. Learning from other’s mistakes is a smart and short path to become Successful Trader.

What is Strangle Option?

Strangle options is a popular strategy in options trading, which involves the simultaneous purchase or Selling of a call option and a put option on the same underlying asset and expiration date. What sets this strategy apart is the use of different strike prices for call and put options. Traders typically use strangle options when they anticipate substantial or low-price volatility but are unsure of the asset’s direction of movement.

This approach allows investors to take advantage of significant price movements in either direction. By acquiring one call option and one put option, the trader can buy or sell a ” strangle”. If the price experiences a substantial movement in either direction or non-direction, the value of one of the options will increase, potentially offsetting any losses incurred by the other option.

If the price of the underlying asset remains relatively stable or exhibits negligible volatility, both options may expire worthless, resulting in losses for the Long and profit for the short traders.

There are two main types of strangle option strategies: long strangle and short strangle.

Long Strangle:

The long strangle strategy is an options trading approach in which an investor acquires a call option and a put option on the same underlying asset, both with the same expiration date but at different strike prices. This strategy proves beneficial when the investor expects substantial price volatility in the underlying asset but is uncertain about the direction of the price movement.

Here is a step-by-step description of how to execute the Long Strangle strategy:

1. Select the underlying asset: Choose a specific stock, index, or other asset on which you want to apply the long strangle strategy.

2. Set Expiration Date: Set the expiration date for the options. It is recommended to align the expiry date with the expected time frame of anticipated price volatility.

3. Select the strike price: Select a higher strike price for the call option and a lower strike price for the put option. The difference between the strike prices will be affected by the expected magnitude of the price movement.

4. Buy Call Option: Acquire a call option giving you the right to buy the underlying asset at the chosen strike price on or before the expiration date.

5. Buy Put Option: Acquire a put option, which provides the right to sell the underlying asset at the chosen strike price on or before the expiration date.

6. Assess profit and loss potential: Evaluate potential profit and loss scenarios at expiration. The long strangle strategy provides unlimited profit potential if the price of the underlying asset experiences significant volatility in either direction. However, the risk is limited to the premium paid for both the options.

7. Manage the trade: Regularly monitor the price changes of the underlying asset and any changes in implied volatility. Consider exiting the trade early if the trade reaches a predetermined profit target or if current conditions change.

The long strangle option strategy proves beneficial when a significant price movement in the underlying asset is expected due to a major event or announcement, such as an earnings report or regulatory decision. By implementing this strategy, investors can profit from market volatility without accurately predicting the direction of price movement.

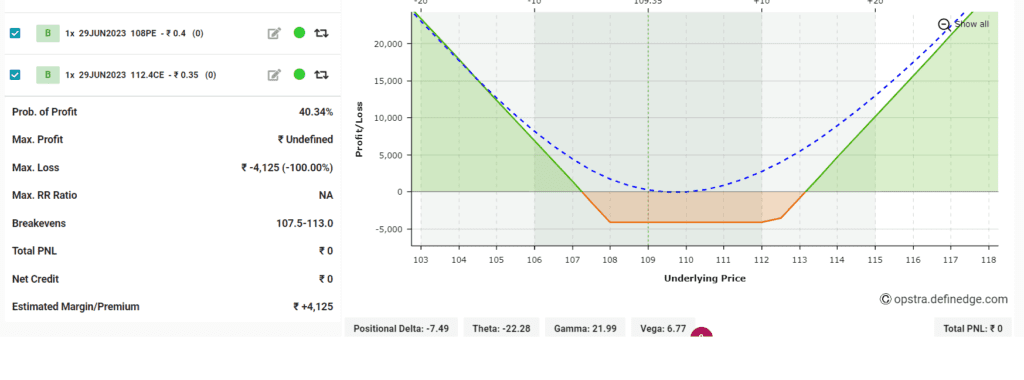

Suppose you are trading stock XYZ, which is currently priced at $109. You expect significant price volatility in the near future but are uncertain about the direction of the price movement. You decide to implement a strangle option strategy by purchasing the following options:

Long Strangle Payoff:

Call option: Strike price $112.4, premium $0.35

Put option: Strike price $108, premium $0.4

Here’s the payoff chart illustrating the potential profit or loss at expiration, assuming you hold both options until expiration:

Short Strangle:

The short strangle strategy is an options trading approach where an investor sells (or writes) both a call option and a put option on the same underlying asset with the same expiration date, but at different strike prices. This strategy is typically used when the investor anticipates low volatility in the underlying asset and expects it to remain within a specific price range until expiration.

Here is a step-by-step description of how the short strangle strategy works:

1. Select the underlying asset: Choose a specific stock, index or asset on which you want to apply the short strangle strategy.

2. Set Expiration Date: Set the expiration date for the options. It is advisable to choose an end date that is in line with the expected time frame of the estimated price range.

3. Select the strike price: Select a higher strike price for the call option and a lower strike price for the put option. The difference between the strike prices will depend on the desired price range within which the investor believes the underlying asset will remain.

4. Sell Call Option: Write (sell) a call option, which obliges the investor to potentially sell the underlying asset at the chosen strike price on or before the expiration date.

5. Sell put option: Write (sell) a put option, which obliges the investor to potentially buy the underlying asset at the chosen strike price on or before the expiration date.

6. Assess profit and loss potential: Evaluate potential profit and loss scenarios at expiration. The short strangle strategy makes a profit when the price of the underlying asset remains within the desired range until expiration, rendering both the call and put options worthless. However, if the price moves far beyond the strike prices, the losses can be substantial.

7. Manage trades: Monitor the price changes of the underlying asset and any changes in implied volatility. If the position reaches the desired profit level or there is a significant change in market conditions, consider closing the position prior to expiration.

The short strangle option is employed when the investor expects limited price movement for the underlying asset within a specific range. By selling both call and put options, the investor collects the upfront premium. However, it is important to be aware of the unlimited risk associated with this strategy if the price of the underlying asset moves significantly beyond the strike prices.

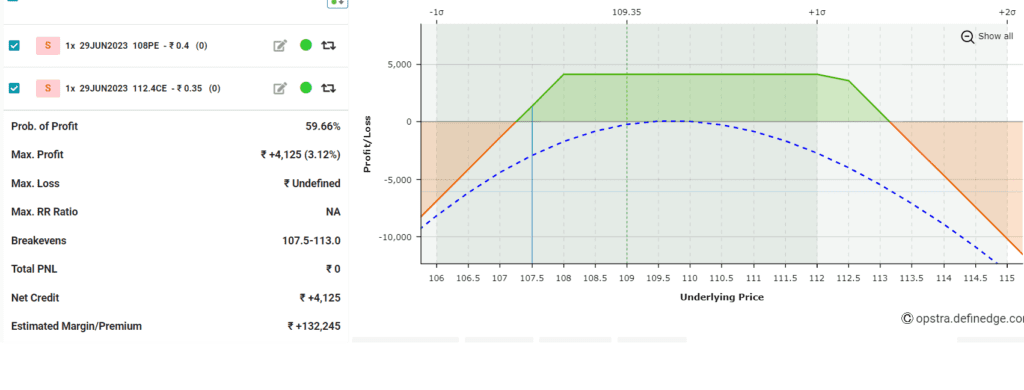

Suppose you are trading stock XYZ, which is currently priced at $109. You expect low price volatility in the near future and expects limited price movement for the underlying asset within a specific range. You decide to implement a strangle option strategy by Selling the following options:

Short Strangle Payoff:

Call option: Strike price $112.4, premium $0.35

Put option: Strike price $108, premium $0.4.

Here’s the payoff chart illustrating the potential profit or loss at expiration, assuming you hold both options until expiration:

Conclusion

It is important to note that options trading involves risk, and it is advisable to have a thorough understanding of options, market dynamics and risk management strategies before implementing the Long and short strangle strategy or any other options strategy.

Wow, it’s nice and great way to apply this rule. Very informative 👏 👌 👍

Thanks, Gaurav, for visiting and commenting my Blogpost.